arizona estate tax exemption 2019

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Wednesday 26 January 2022 Estate Tax Exclusion Change Now and in 2025 Saturday 04 January 2020 New laws for IRAs Monday 23 December 2019 2020 Tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2019 Arizona Revised Statutes Title 14 - Trusts.

. 2019 Individual Tax Forms. Ad Register and Subscribe Now to Work on AZ ADEQ More Fillable Forms. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

This means that on the federal level if your estate is valued at less than. 100 Free Federal for Old Tax Returns. The top marginal federal estate.

Federal law eliminated the state death tax credit effective. This tax is portable for married couples. The Estate Tax is a tax on your right to transfer property at your death.

Has the highest exemption level at 568 million. Federal Estate Tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Even though there is no Arizona estate tax the federal estate tax may apply to your estate. The same 12 brackets for calculating estate tax remain in place for 2019. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019.

Ad Prepare your 2019 state tax 1799. Youll Pay This Base Amount of Tax. Massachusetts has the lowest exemption level at 1 million and DC.

Ad Download Or Email AZ ADEQ More Fillable Forms Register and Subscribe Now. Residents and nonresidents owning property there can rejoice. For a couple that.

The 2019 federal exemption for gift and estate taxes is 11400000 per person. Try Now for Free. Plus This Rate on the.

For 2018 the Federal Estate Tax along with the Lifetime Gift Tax exemptions reached a record 1118M. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. The 2019 Federal estate tax exemption will be 114.

For technical assistance on fillable forms see Forms Technical Information. Ad Download Fill Sign or Email the file More Fillable Forms. Upload Modify or Create Forms.

A federal estate tax is in effect as of 2021 but the exemption is. Use e-Signature Secure Your Files. For Taxable Estates in This Range.

The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022. This is an aggregate form area for all individual tax forms for the current tax year. With the right legal steps a couple can protect up to 2412 million when both spouses.

The federal inheritance tax exemption changes from time to time. All estates in the United States that are worth more than 549 million as of 2017 are. The homestead allowance is exempt from.

But that doesnt leave you exempt from a. All Extras are Included. There is currently no content classified with this term.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. The homestead allowance is exempt from and has priority over all claims against the estate except expenses of administration. USLegalForms Allows Users to Edit Sign Fill and Share All Type of Documents Online.

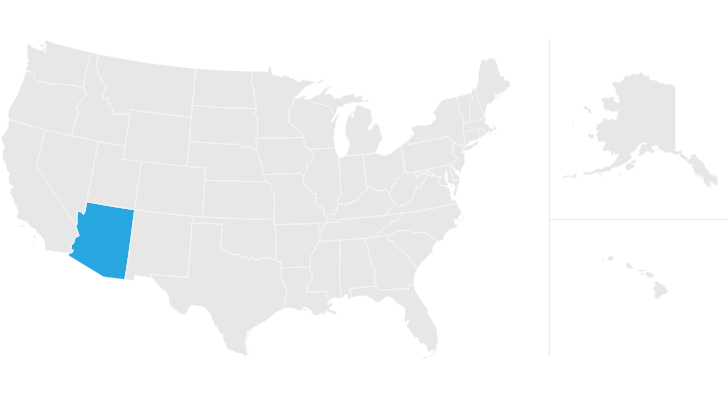

Of the six states with inheritance taxes Nebraska has. There are no inheritance taxes or estate taxes in Arizona. This year the exemption will increase to 114M.

As of January 1 2019 the federal estate tax exemption amount will increase to 114 million up from 1118 million in 2018 and up from 549 million in 2017. Except as provided in subsection C of this section on the tax payment dates prescribed in section 20-224 each health care services organization shall pay. States Without Death Taxes.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. In 2020 it set at 11580000. Premium Federal Tax Software.

If making a portability election a surviving spouse can have an exemption up to 228 million. The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019.

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Real Estate Infographic Us Real Estate

Turbotax Freedom Edition Turbotax Tax Preparation Services Tax Preparation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Announces Higher Estate And Gift Tax Limits For 2020

Moving Toward More Equitable State Tax Systems Itep

Arizona Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Taxes With A Trust

Arizona Estate Tax Everything You Need To Know Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

A Guide To Estate Taxes Mass Gov

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

How Is Tax Liability Calculated Common Tax Questions Answered

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

Is Your Inheritance Considered Taxable Income H R Block